One of the world’s largest disaster risks in Japan (Interview)

September 2, 2020

REIT JAPAN 2020 Interview Japan’s World’s Largest Natural Disaster Risk

Mr. Nobuyuki Hiraizumi

Chairman of Kajima Institute of International Peace.

Director of Kashima Construction Co., Ltd. Nobuyuki Hiraizumi

This time, we spoke with Mr. Nobuyuki Hiraizumi, Chairman of Kajima Institute of International Peace and Director of Kashima Construction Co., Ltd., about the risks of natural disasters in Japan.

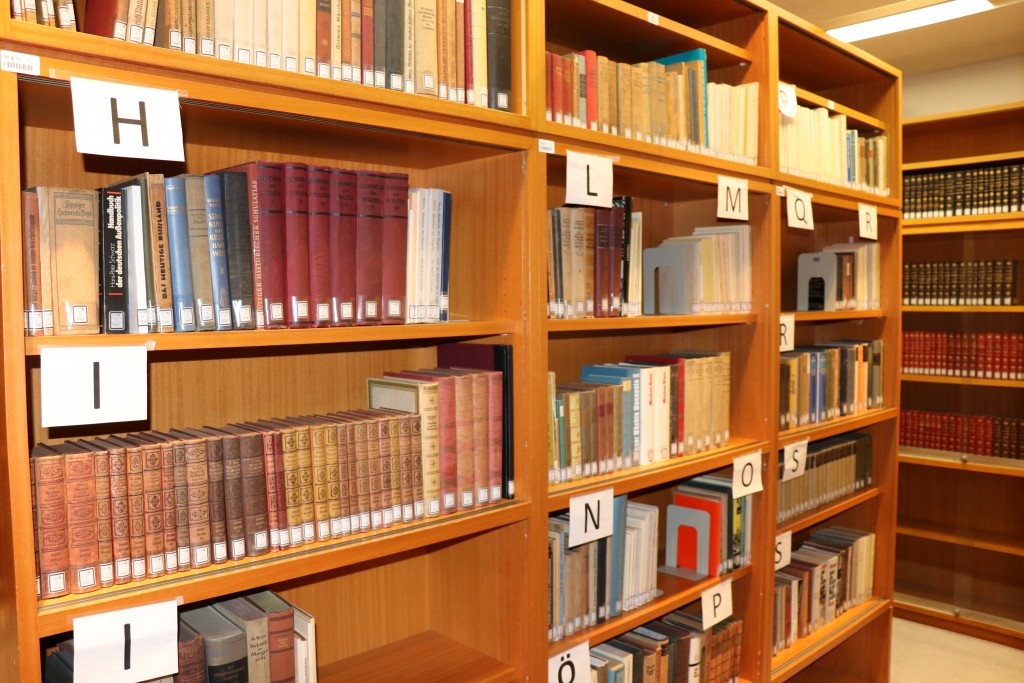

RJ> Thank you for your time today. I was surprised by those books, these are historical diplomacy related documents, correct?

These are important materials related to diplomacy, and their essence (treaties, agreements, memorandums, declarations, statements, etc.) is summarized in the form of the Foundation’s “Basic Documents of Contemporary International Relations (Part 1) (Part 2)”.

In addition, records related to the postwar Japanese economy and records on the management of Kajima Construction at the time led by Morinosuke Kashima remain in the form of books and other forms.

Reitjapan interviewers are also history lovers, and this time Mr.Hiraizumi showed those precious 50,000 books, one of Japan’s largest diplomatic documents, and a library on civilizations such as Europe and China. Hiraizumi’s deep insight into the civilization of his family was unparalleled, with diplomats, ministers, and scholars (professors at the University of Tokyo, etc.) being produced. Currently, he is also the president of the Kashima Peace Research Institute, regularly hosted meetings of experts and research groups, and is an organizer and patron of Japanese foreign policy and peace studies in the international community.

RJ> overwhelmed. I think it’s related to the talk about the risk of natural disasters this time, but if you like, could you tell us a little bit about the Kashima Peace Research Institute, where Mr. Hiraizumi is chairman?

From the Cuban crisis in 1962, when the U.S. and The Soviet Union went to the brink of nuclear war, to the conclusion of the SALT I (First Strategic Arms Limitation Negotiations) in 1972, in Asia, from the Gulf of Tonkin incident in 1964 to Nixon’s visit to China in 1972 or the end of the Vietnam War in 1973, japan was still at high risk of being caught up in the war as a front-line country in the so-called Western and liberal camps. The Kashima Peace Research Institute was established in 1966 by my grandfather Morinosuke Kashima (former diplomat, then a member of the House of Councillors, then Chairman of Kashima Construction) to investigate, research, and make recommendations on how to avoid disasters such as World War II again against the backdrop of such international situations. It was not founded because there was already the Kashima Research Institute, and it was worried about the international situation in East Asia and named it peace.

After morinosuke Kajima’s death in 1975, the institute was effectively succeeded by my father, Wataru Hiraizumi, who was then a member of the House of Councillors (then a member of the House of Representatives). He is also a diplomat fluent in French, English, German and Russian, and when you look into the room, you can see him sitting deeply on a sofa and playing a page of Japanese and Western books with a highlighter in one hand. He used the institute as a private policy debate salon where junior foreign bureaucrats and former Science and Technology Agency bureaucrats, who served as ministers, went in and out, and as a politician, he was in a position to implement the results of the salon = policy proposals, so his exposure to the public was limited.

Wataru Hiraizumi died in 2015, and algan to be a former diplomat, not an amateur, a politician, and not in a position to implement the policies proposed by the Institute, but 20 years of helping my father run the foundation, I was entrusted with the management of the institute. For the time being, I’m thinking about (1) japan’s declining industrial competitiveness, (2) bloated social security benefits due to demographic changes, (3) fiscal crises associated with the former two parties, and (4) responding to natural disaster risks that increase due to rising sea levels. At the root of this is a hidden awareness of the problem of Japan following the same rut both before and after the Meiji Restoration in the 150 years since the Meiji Restoration. In other hand, if you set a national goal, you will achieve it splendidly, but you will not be able to set a new goal by adapting to the environment that has changed with the achievement, and you will fall into a predicament without changing your way of doing things. I want to do something about deep and surface problems.

This shelf is for German documents.

Morinosuke who was a diplomat in Berlin at that time at the hyperinfl inflation after the first great war bought it in two bundles three sentences, was taken back, burned down in the second great war now, and is a book concerning a very valuable political economy in Germany. In Berlin, he was greatly influenced by the fact that his mother was Japanese and with count Richard Koudenhof-Karelgi, who is said to be the born father of the EU, and translated his books one after another in Japan, starting with Pan Europe.

This shelf is for Italian documents.

Italy is morinosuke’s second-only place of assignment after Germany, and he was stationed there for three years from 1927. About 20 years after seizing power in 1922, Italy is a national Fassisto party government. By the way, the 1929 general election held during the expatriate period was a de facto vote of confidence in the list of 400 candidates presented by the National Fascist Party, with a turnout of about 90% and a vote of about 98% in favor of the party. Brexit, the birth of President Trump, and the recent years of populist government in Eastern Europe make us feel the second coming of the 1930s. What came after that is war, so you need to be vigilant.

RJ> I see. That’s true. There is a reality when you say that there is only this literature and the person who is actually working variously in the foundation.

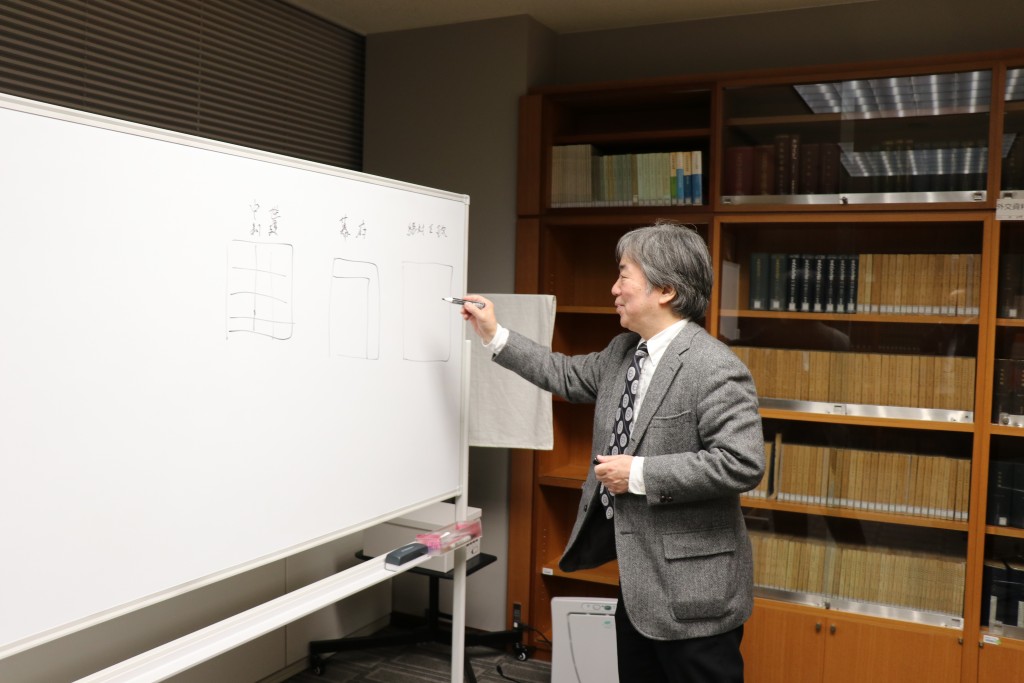

As the next project of REITJAPAN, while talking about the new real estate-based finance in the age of the Internet, when I consulted about the state of governance, I immediately had a very easy-to-understand lecture on the transition of the global political system.

Hiraizumi-san’s Lecture on Political History

Natural Disaster Risk

RJ> Then, may I talk about mr. Hiraizumi’s theory about the risk of natural disasters in Japan?

I am aware that the Foundation has been participating in disaster risks during the eruption of Mt. Fuji and study groups on large-scale earthquakes, and on the other hand, I have been diligently researched and on the other hand, I am committed to building buildings with high earthquake resistance as a leading generale of Japan, but I hope that this time, if you are new to it, please let me know, first of all, I would like you to talk from an easy-to-understand point. Thank you.

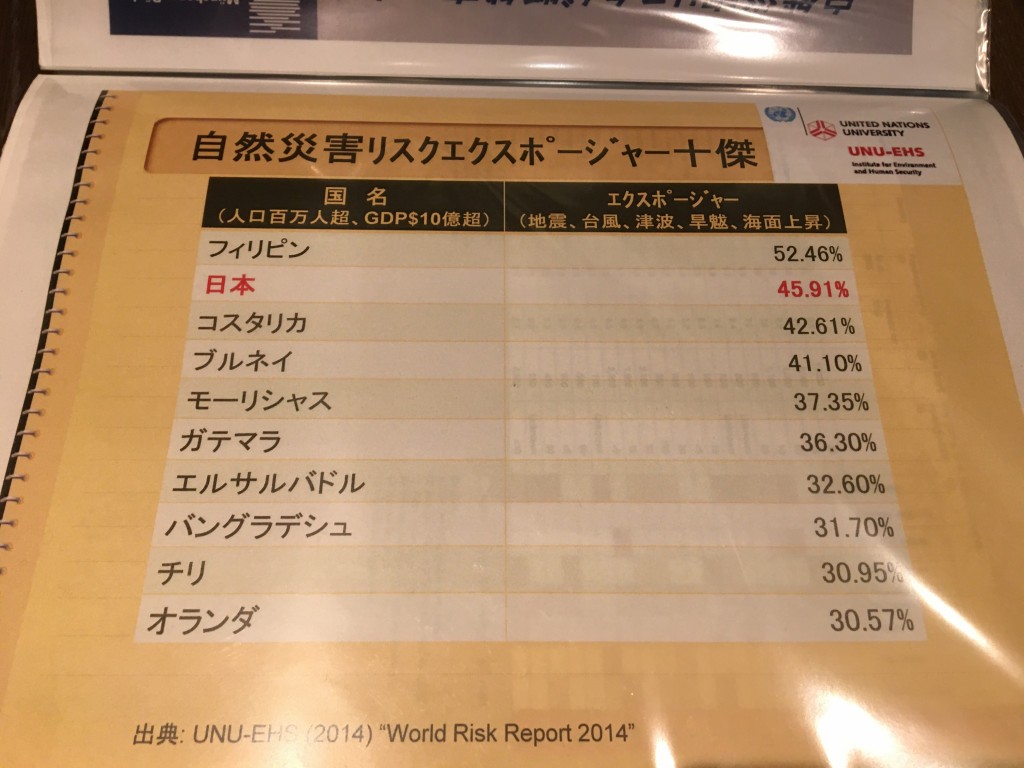

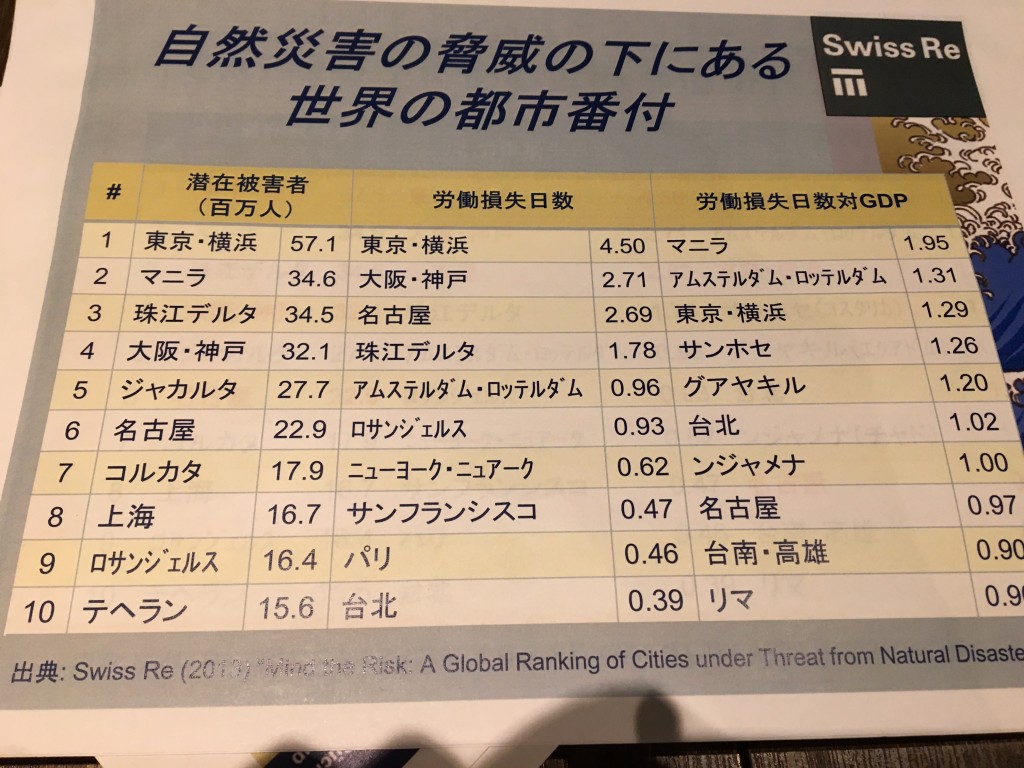

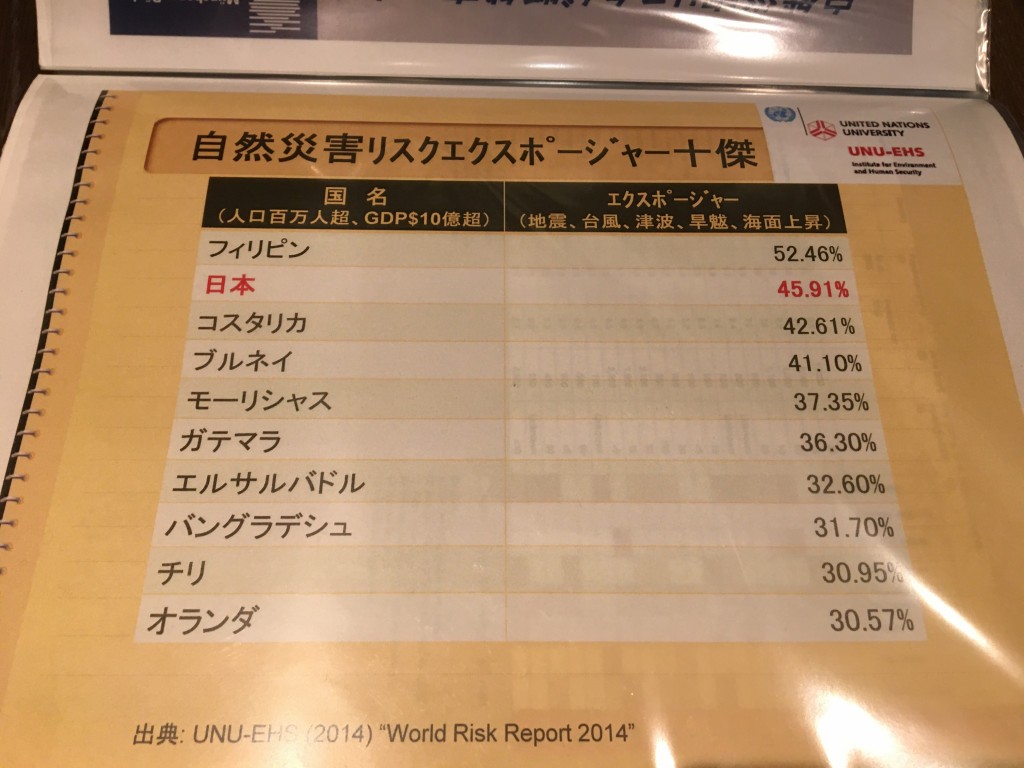

According to the United Nations University, Japan’s exposure to natural disaster risks (earthquakes, typhoons, tsunamis, droughts, and sea level rise) is the second highest in the world after the Philippines, among countries with populations of more than 1 million and GDP of more than $1 billion (excluding Pacific island countries facing sea level rise risk). Among the top 10 countries, the largest economies are Chile and the Netherlands in addition to Japan, and japan in particular is the third largest economy in the world, so there are many assets affected by exposure to natural disasters, and it is assumed that the negative impact on the economic scale is also large.

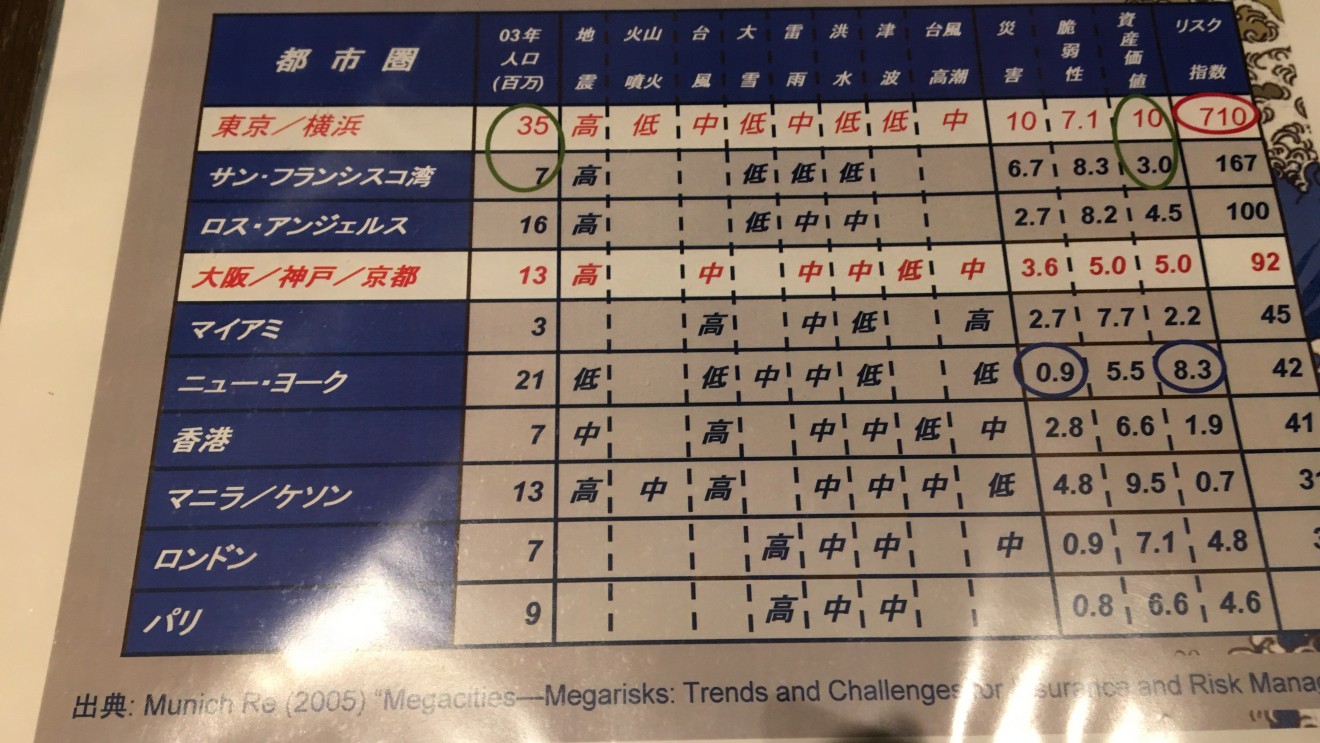

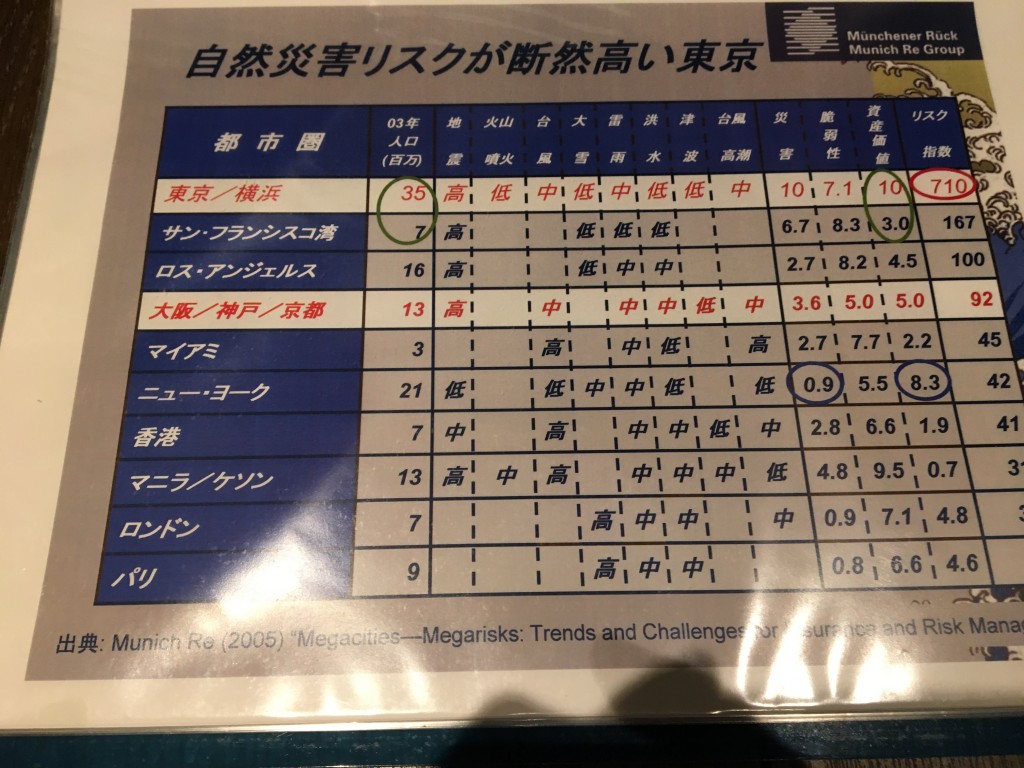

In fact, Munich Reinserever, the world’s largest reinser insurer (an insurance company that globally distributes the risks of insurers, wholesale insurers, and former non-life insurance companies that are usually undertested within a single country), used experts’ knowledge to Due to the frequency and intensity of disasters that hit the area, the ground conditions and building standards of the region, and the large number of assets accumulated, it is the city area with the highest risk of encountering damage from natural disasters in the world, and the degree is more than four times that of the second-place San Francisco Gulf Coast region (population 7 million). This is explained by the fact that the accumulation of populations is effective in accumulating assets, and that Tokyo is exposed to the risk of typhoons, storm surges, and thunderstorms in addition to earthquakes, in addition to earthquakes, in the San Francisco Bay Area, where exposure to natural disasters is exclusively earthquakes. On the other hand, the New York area, which has a population of 21 million and is second only to the Tokyo metropolitan area, is close to Tokyo due to the accumulation of assets, but natural disasters themselves are estimated to be at 1/10 the level of Tokyo, and as a result, the risk of encountering natural disaster damage is only 1/17 of that of Tokyo.

Similar research studies have been conducted by other major reinserevers, such as Swiss Reinser insurance and Lloyds, and have been similar. Not only the Tokyo metropolitan area, but also Keihanshin and Nagoya are at higher risk of being severely damaged by natural disasters than other metropolitan areas around the world. Well, it is an archipelago located in the place where four plates of North America, the Pacific Ocean, the Philippine Sea, and Eurasia collide, so it is not possible.

Source: UNU-EHS(2014)”World Risk Report 2014″

Source: Munich Re(2005) ” Megacities – Megarisks: Trends and Challenges for Insurance and Risk Management

Source: Swiss Re(2010) ” — Risk: A Global Ranking of Cities under Threat from Natural Disaster ”

Source: Lloyds

RJ> it means that Tokyo is overwhelmingly risky. In addition, not only Tokyo but also Japan as a whole is so, and not only earthquakes but also typhoons were manifested in last year’s large typhoons, but in the first place, it has been estimated that way for a long time.

Last year, there were facilities to avoid the water of the Arakawa River, and I recognize that the important part of the metropolitan function was somehow not affected, but there is a deep understanding of such disaster risks, and actual measures are being taken from the standpoint of construction.

It is not necessarily an answer to the question, but in the case of Japan, including the Tokyo metropolitan area, we should seriously consider measures to mitigate accumulation even a little while taking disaster prevention measures in response to the overwhelming natural disaster risk. There is no doubt that people like people, like accumulation, and have increased the efficiency of people’s cooperation by accumulation because it is a Japanese who has built a dense city like Edo and Tokyo and the world of the same age. However, there is a limit to anything. In particular, there are side effects of exposure to natural disaster risk, so I think we should balance it some time.

Just as a pandemic is hitting the world, I think it is better to think that a new virus of animal origin comes out at regular intervals from China, which has a long habit of eating a wide range of animals in nature as longevity drugs at the same source of medical food (in China). Japan is china’s neighbor, and it will continue to be a good tourist destination for Chinese people, otherwise Japan will be in trouble. Then, it is necessary to factor in the risk that a large amount of Chinese tourists and long-term visitors enter the country with the virus every year. One way to weave is to create a less dense city. We are forced to introduce telework as a countermeasure against pandemics, but this should help us learn how to work while in a remote location, and how to work together to advance projects.

Germany is famous in developed countries when it is called decentralization, but 300 Countries of the Holy Roman Empire are the ground. Japan was also divided into 300 clans before the abolition of the feudal domain, and there are IT, Shinkansen, and airplanes, and autonomous vehicles will be realized in the future, so there will be no need for everyone to accumulate in Tokyo or the cities at the mouth of the Okizumi Plain. With a GDP per capita of about $40,000, it’s funny that 120 million people move under the same rules and DOS. I think that a network in which regions with strong personalities nurtured under different rules work together to create new value and grow more innovatively than a centrally available hierarchical structure, both in the do state system and in the federal state. In short, is a multi-pole decentralized nation two birds with one stone of risk management and growth strategy? If you are poor, have no assets, and have no human resources, you only have temporary and hierarchical structures to leverage few assets and human resources. However, as we become richer and our human resources and assets become more substantial, the risk of being exhausted by natural disasters increases due to accumulation. We must protect human resources, which are intangible assets that are expensive to develop through dispersion.

RJ> Not only construction, but also the ideal way of the city and the ideal way of civilization are thought spatially, and as expected, it is amazing after all. It is an impression that the top of the industry related to the construction still has a similar problem consideration in the top of the industry related to the construction, too, and masonic related to the construction of a modern nation seems to have originated.

RJ> Then, there are various urban theories and natural disasters, so I think that you can talk about each of them, but I think that you can talk a little deeper about the earthquake that we are taking in with interest, for earthquakes, it seems that in California, data are being acquired from detectors installed in buildings, but the Tokyo Metropolitan Government, etc. If the risk is higher than in California, I’d like to recommend a similar attempt. At that time, hiraizumi-san has said that it is related to insurance, but the other day in the United States, a fund that predicted subprime and made a grade was claimed to be able to contribute to the solution of global warming etc. due to the relationship between natural disasters and insurance premiums, and it was said that he was a fund manager of an owner GP who is excellent in the United States. I thought that there was such a viewpoint.

In addition to mitigating the accumulation of cities, it is better for Japan to think a little more about the use of non-life insurance. Japan is the fourth largest non-life insurance company in the world in sales (former premiums received) in the non-life insurance industry, but it ranks 24th in the ratio of GDP to 23rd in premiums per capita (2017, “Japan’s Non-Life Insurance: Factbook 2019”). In addition, about 60% of this non-life insurance sales are from automobile insurance and automobile liability insurance, and only 14% of fire insurance responds to natural disasters (FY2018, “Japan’s Non-Life Insurance: Factbook 2019”). Since GDP per capita is ranked 28th, the 23rd place in premiums per capita is still accepted, and the 24th place of GDP is clearly underreassed.

In the first place, there are four ways to deal with risks, including natural disasters, by avoiding, mitigating, passing on, and possessing risks. Avoidance is to avoid dangerous locations, such as soft ground or floodplains. In addition, mitigation is to reduce damage by, for example, constructing with specifications exceeding the Building Standards Act, which is the lowest safety standard, dispersing the location, and repair work to prevent earthquake resistance and flooding. In addition, the transfer is a mechanism in which, for example, the risk is passed on to the insurance company in exchange for insurance premiums, and if the risk becomes a reality and damages are incurred, the insurance company that undertered the risk pays the insurance claim and receives it. Finally, it is a holding, but it is to deal with the damage with equity capital.

In countries with a large risk of natural disasters, such as Japan, it is necessary to mobilize all four measures to confront them. If insurance is not fully utilized, one of these measures (transfer) will be used underlying it. Of course, in natural disasters where the whole region suffers damage and damage in the first place, there is a side that the large number of laws that are the principle of insurance does not work because the risk event is not independent, and insurance does not work, and there is a view that it is unreliable, but there are former victim insurance companies, reinserevers, institutional investors who invest in natural disaster bonds and natural disaster derivatives that challenge risks, Since insurance products are supplied, they should be used.

I believe that the reason why the use of non-life insurance does not permeate is the lack of risk literacy and financial literacy symbolized by the expression “disposable insurance”. It is said that it is a bad thing to throw away because there is no savings, so if a natural disaster does not occur, insurance money will not be paid, but it will cost money and interest to provide security for a certain period of time (securing or booking accidental capital). Insurance premiums are not thrown away, but the consideration of coverage. Savings-saving and expensive reserve insurance is a financial instrument unique to Japan, and in the U.S., it is clearly divided into deposits and insurance, and it is a divisional balance specialized in functions. The relative magnitude of Japan’s natural disasters and practical methods for dealing with them should be educated by financial planners and non-life insurance company sales representatives if teachers can’t do it in the process of compulsory education. It is not a money-paying principle or a commercial principle, but a knowledge that you should know because you were born in Japan, and constitutes one item of Tricets.

In California, a non-life insurance company specializing in non-profit, state-owned residential earthquake insurance called California Earthquake Authority sells earthquake insurance, and although there are fewer subscribers due to high insurance premiums and large deductibles. It is an insurance in which risks are subdivided by location, construction year, structure, etc. If you show the data, it may reflect that the insurance premium rate may be greatly reduced. In the U.S., it is generally called the fire industry (FIRE=Finance, Insurance, Real Estate) industry, but real estate is the most expensive purchase for both natural people and corporations, so it is not purchased in full cash, Some bank borrowings are used to help with the leverage effect associated with write-off of interest expense (borrowing at the low after-tax cost of debt increases the return on equity), but it is often possible to procure borrowings unless non-life insurance is maintained to maintain the secured value of the property. Real estate, insurance and finance are inseparable.

RJ> In that sense, as far as Japanese finance is concerned, it seems that calculations have not yet begun for the time being. We also have a base in California, so we hope that we can contribute something to this media so that we can start with calculations in cooperation with the Japanese industry and California practices.

What > about the wind and flood damage that became a major problem last year when RJ said? Do you have the impression that the government is still increasingly investing as a national stock in measures against wind and flood damage?

Regarding wind and flood damage, as a result of the rise in the temperature of the sea surface, as a result of the occurrence of typhoons going north, it is remembered by reinsans companies for at least 10 years that things that had crossed the Japanese archipelago in one place and passed through the Sea of Japan, such as typhoons Muroto, Makurazaki, and Isewan, would take a course and cause enormous damage from Kyushu to Hokkaido. It is clear that rising sea levels and rising sea surface temperatures due to global warming have combined to cause severe wind and flood damage, and there is no time for Katrina (New Orleans), 2012 Sandy (New York), Harvey (Houston) in 2017, heavy rains (Hiroshima) in July 2018, and Typhoon East Japan in Reiwa years (Nagano).

Wind and flood damage must also be addressed through avoidance, mitigation, transfer, and total mobilization of ownership. Do not build buildings on floodplains as much as 2016. The U.S. has federally insured flood insurance, but this basic idea is that if the federal government agrees to avoid construction on floodplains on a municipal basis, the federal government will take on insurance, and if it wants public relief, it will induce private economic activity by a policy of not building on floodplains. Japan should also establish a system in this form to avoid dangerous locations and dangerous building structures. For example, earthquake insurance should be conditional on compliance with the Building Standards Act of 1981. According to estimates 10 years ago, insurance money can cover 90% of the cost of rebuilding a house. I think it would be good to apply the design philosophy of federal flood insurance in the United States to wind and flood damage.

With regard to transfer, mainly insurance, we rely on reinserevers who are globally taking on risks in regard to fee rates and capacity, and there are some difficulties in the circumstances of former non-life insurance companies in Japan, but I think that the drastic solution will be to introduce “land prices and real estate prices adjusted for natural disaster risks”. Current real estate prices are determined only by economic factors such as the present value of future rents, supply and demand, etc., but the value should not be discounted by natural disaster risks that conceptually hinder future rents, rather than interest rates that cost capital opportunity losses. This will cause significant fluctuations in land prices and real estate prices, causing confusion in society, but if we do not take measures to mitigate the changes and adjust for risks, we will leave the current situation where prices are distorting the market by false signals. In other things, people, goods, and money are gathered in places that are convenient for economic activities but vulnerable to natural disasters.

As for why this happened, I think it is the vertical division of central government offices and the division of roles to increase the efficiency of reconstruction from the Great Kanto Earthquake before the war and reconstruction from mainland bombing after the war. As a result of the vertical division of the former Ministry of Construction and the former Ministry of Finance, which creates a division between the rules of asset formation (building standards) and the rules for operating assets once formed (property tax – former Ministry of Home Affairs, service life and depreciation, insurance), and originally, the building standards that should be decided between the insurance industry and the architectural engineering teacher are decided without the input of the insurance industry, Taijong buildings in Japan are charged a high rate of fees in the global reinserpable market, and as a result, buildings of Japanese corporations are largely uninsured except for 100 captive insurance companies (insurance subsidiaries owned by global companies in the Group). According to executives of foreign insurance companies, less than 10%. By the way, real estate holdings by corporations are about 550 trillion yen, which is a large part of national wealth of about 3,000 trillion yen.

While Japan’s building standards are set at a level where buildings collapse and there are no deaths, insurance emphasizes collateral value, which is the ability to earn rent and generate cash flow in the future, which is naturally higher than the level at which there are no deaths. It is quite difficult to bridge this gap, but it is essential to use insurance or risk transfer mechanisms.

Finally, it is the holding of risks, but as a country, it is desirable to be able to become a non-life insurance company of the people, maintain a fiscal surplus in the flow, and have government surplus (reserve) as a stock, but it is not in such a state with public debt exceeding 200% of GDP very much. In that case, we believe that we must consider a system that allows individuals to reserve money to prepare for natural disasters and does not tax their operating interests. Of course, it is necessary to devise the operation so as not to become tax evasion, but since the country can not take care of it, there is no other way but to have the people do it. However, since the gap between rich and poor expands further, it may be necessary to devise income transfer.

RJ> “Land prices and real estate prices adjusted for natural disaster risks” have a considerable impact on REITs and other real estate industries, but if you think seriously, I think that it is possible to avoid that.

RJ> Also, it may be humbling to say that “the result of decided the building standards that should be decided between the insurance industry and the architectural engineering teacher without the input of the insurance industry”, but it may be that the insurance industry should decide through dialogue with the input of the architectural engineering teacher. Compared to people who are actually being built in complex field needs, the financial side such as the insurance company side moves virtually, so it should be able to respond flexibly originally, and there are also financial aspects such as REITs, so it may be possible to respond relatively quickly.

RJ> Hiraizumi’s theory is that GPIF should bring REIT and other products, but in the sense of spreading the REIT industry and promoting recognition, could you introduce it in that direction?

Considering the risk of natural disasters in Japan, in principle, I think that a rented house should be recommended, not a home. Ultimately, for reinserevers or investors to take on disaster bonds, and for former property and disaster insurers to be able to sell insurance, they would have to raise their building standards considerably, and such homes would be expensive and two-generation loans, increasing the risk of encountering natural disasters in the mean time and increasing the risk of dual loans. Therefore, if you dare not have a house and want to build a robust rental house, for example, a long-term investor GPIF owns it, rent it from there, and make it an asset, I think that it should be a security in the form of the right to live in a house with rent X yen for Y years.

RJ> I think that everyone in the REIT industry is exactly in favor, thank you.

RJ> This is a good thing for you, but it is called a hobby, or there is a lot of time that is almost hit by literature, etc., but is there such a scholar or a book?

For about 30 years, I’ve been creating, exchanging, explaining, and commenting on the best books, fiction and documentary films I’ve read with friends, and the music I’ve listened to, and over the past decade, I’ve been writing with Scottish historian Niall Ferguson, American documentarian Michael Lewis, Nassim Nicholas Taleb, a Lebanese former hedge fund manager, Morihide Katayama, Yukio Noguchi, Soki Watanabe and David Atkinson, a former Goldman Sachs player, were regulars in the top 10.

Jayne Jacobs : Systems of survival: a dialogue on the moral foundations of commerce and politics, 1992, was the best book of the decade in the 1990s (1990-1999). Recently, in the movie ” Motherless Brookly” directed by Edward Norton, a famous director, depicted the conflict between Jacobs and Robert Moses in the documentary “Jayne Jacobs: Citizen Jane: Battle for the City”, or his book, “The death and life of great American cities”. The role of Robert Moses (under the name Moses Randolph in the film) was played by the great actor Alec Baldwin, and I was impressed by the overwhelming monologue scene shown in David Mamet’s film ” Glengarry Glen Ross”. I pray for Ms. Jacobs’ soul.

RJ> Thank you very much today for your very educational and inspiring talks and for showing us a very valuable books and the library.